reit tax benefits uk

A real estate investment trust REIT is a property investment company which very broadly simulates from a tax perspective direct investment in UK property and so avoids the additional layer of taxes that can arise when investing through a corporate structure. Since then the regime has continued to evolve with a number of developments.

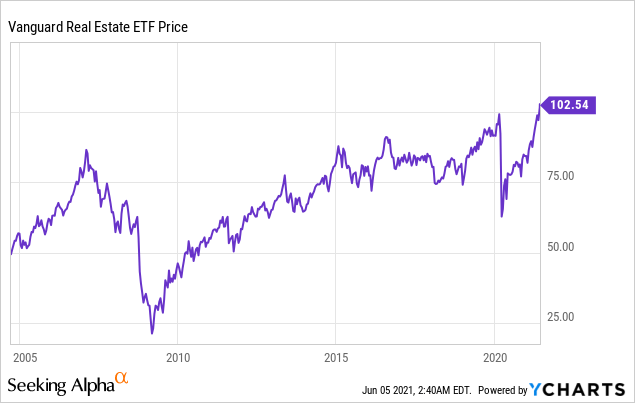

New Etfs To Watch Consumer Reports Bond Funds Investing For Retirement Mutual Funds Investing

For UK resident individuals who receive tax returns any normal dividend paid by the UK REIT is included on the return as a dividend from a UK company.

. Market capitalization weighted indicies designed by Wachovia to measure the performance of the US. Using a UK-REIT means there is no direct tax. Tax transparent Potentially high-yield returns.

This corporation tax is paid by the company before any dividends are paid out to investors. Your dividend voucher will show your shares in the company the dividend rate and the tax. A Real Estate Investment Trust REIT is exempt from UK tax on the income and gains of its property rental business.

You can hold investments in REITs in any kind of Individual Savings Account ISA. REIT dividends pay ordinary income at up to 37 a return to 39 under their regular income classification. Access this article for free with a trial of Tolley Guidance and benefit from.

Subject to a number of conditions a UK real estate investment trust REIT is a company or a group of companies with a parent company that has elected to be a REIT under the UK tax legislation. This relaxation will provide a further vehicle for joint ventures with the benefit of liquidity and the additional flexibility. A REIT investor REIT can now invest in another REIT target REIT without a tax penalty so long as the investor REIT distributes to its shareholders the whole of the rental distribution received from the target REIT.

20 withholding tax is. Preferred shares in addition to five. A UK-REIT is exempt from UK corporation tax on profits both income profits and capital gains arising from carrying on a qualifying property rental business.

Each tax year you have an ISA allowance which for the 202122 tax year is 20000. The main tax implications of electing for REIT status are. Income profits and capital gains of the qualifying property rental business of the REIT are exempt from corporation tax.

This is why UK REITs are such a popular vehicle for investing in property. Here are the bank holiday payment dates for the rest of the year. REITs benefit from some pretty special tax advantages.

The London Stock Exchange LSE identifies the following benefits of REITs for UK investors. Investing in a REIT is passive but it also allows you to invest a relatively small amount of money. UK REIT property income distributions are taxed as property income.

Real Estate Investment Trusts REITs were introduced in the UK. Expert practical tax guidance. A separate study was conducted a decade ago projecting 66 in 2026.

These three REITs have an average dividend yield of 67. The ongoing benefits of REIT status together with. A real estate investment trust REIT is in fact not a trust at all it is a company which qualifies for special tax treatment under CTA 2010 Part 12.

Investors in the 10 or 15 tax brackets pay no long-term capital gains taxes while those in all but the highest income bracket will pay 15. Invest more than 75 of their assets in different types of property. The UK Real Estate Investment Trust REIT regime launched on 1 January 2007 immediately saw a number of the UKs largest listed property companies convert to REITs.

The UK REIT regime uses a ratio test that compares profits of a UK REIT. If you deduct the 20 tax rate from your account then your highest effective tax rate would be 29. With the same underlying property investments a REIT would provide a higher shareholder return than a standard investment trust.

If the REIT held the property for more than one year long-term capital gains rates apply. Advantage 3 - Tax Efficiencies. 2 August 2022.

Corporation Tax is payable on its profits and gains from any other activities. Part 12 of the Corporation Tax Act 2010 provides for a special tax regime for Real Estate Investment Trusts UK-REITs. Shareholders who fall into the highest income tax bracket currently 37 will pay 20 for long-term capital gains.

Ad Potentially Access Up To A 20 Tax Deduction On Qualifying Reit Income. This means that for a shareholder in a UK-REIT the tax impact is similar to direct investment in real estate. REIT Tax Benefits No.

The money you can make on investments held in ISAs up to this allowance is free from Income Tax and Capital Gains Tax CGT. In return UK REITs are required to distribute at least 90 of their taxable income for each accounting period to investors where the income is treated. A normal UK company is required to pay Corporation Tax on profits at a rate of 19.

Wachovia Hybrid and Preferred Securities WHPPSM Indicies. Distributions of income profits and capital gains by the REIT are treated as income from a property rental business in the hands of investors. What are the bank holiday payment dates coming up.

The benefits are considerable. In the UK a company or group of companies can apply for UK REIT status which provides exemption from corporation tax on profits and gains from their UK-qualified property rental businesses. Investment income is subject to an 8 surtax.

Real estate trusts are a different animal from typical corporations. Depreciation and Return of Capital. REITs have historically provided investors dividend-based income competitive market performance transparency liquidity inflation protection and portfolio diversification.

These property-owning companies receive tax benefits in return for paying out most of their income as dividends. Ready-made templates step-by-step-guides interactive flowcharts and. REITs offer investors the benefits of real estate investment along with the ease and advantages of investing in publicly traded stock.

To qualify as a REIT companies have to. Fundrise just delivered its 21st consecutive positive quarter. The REIT structure has benefits but is accompanied by obligations.

Earn more than 75 of their gross income from. It also enables exempt investors to benefit from their own tax status. Companies such as British Land and Land Securities have converted to REITs along with most of the UKs largest property companies.

Should You Spend Money On A Rental Property Renovation Property Renovation Rental Property Real Estate Investment Fund

Calculation Of Late Form Gstr 3b Return Filing Fees On Gst Portal Gst Portal Will Now Be Calculating Late Fee Cgst Portal Latest Form Goods And Service Tax

By Putting A Percentage Of Your Money Into Real Estate You Are Not Onl Commercial Real Estate Investing Real Estate Investing Commercial Real Estate Marketing

Beps 2 0 The Two Pillar Approach

Bp Paid Tax To Uk On North Sea Business For First Time In Years Bnn Bloomberg

The Uk S New Asset Holding Company Tax Regime Might You Be Enticed To Be Offshore No More Morrison Foerster Llp Jdsupra

What Is Difference Between Corporation Llc Limited Partnership And Sole Proprietorship In C Sole Proprietorship Limited Partnership Limited Liability Company

Very Bad News For Reit Investors Seeking Alpha

5 Multani Mitti Face Packs Kama Ayurveda Multani Mitti Face Pack Multani Mitti Essential Oils For Skin

Real Estate Vs Stocks Which Is A Better Investment For 2020 Lead Generation Real Estate Best Real Estate Investments Real Estate Leads

Reinventing The Deal Stock Exchange Fertility Rate Word Bank

Real Estate Portals Are Easiest Way To Find Homes Home Buying Has Come A Long Way Since The Last Decade Or So An Activit Cosmic Group Activities Home Buying

Uk Loan Structures Changes To The Anti Hybrid Rules

Why Should I Invest In Reits Savingadvice Com Blog Investing Finance Investing Real Estate Investment Fund

Understanding What Criteria Goes Into Calculating Your Credit Score Is Essential To Credit Health Here Are The Main Fact Credit Score Scores Credit Monitoring

You Can Learn New Ways To Increase The Profitability Your Property Investments By Checking Out Our Real Estate Investment Trust Real Estate Investing Investing